v členskej sekcii sa nachádza informácia z prezídia OZH, kotré sa konalo 21. 2. 2017 v Bratislave

Najnovšie od Mgr. Peter Šagát

533489 komentáre

-

Odkaz na komentáre

pondelok, 27 máj 2024 17:22

Napísal(a) Arden

pondelok, 27 máj 2024 17:22

Napísal(a) Arden

15 Trends To Watch In The New Year Zeus Slot Game slot demo gratis pragmatic play no deposit zeus (Arden)

-

Odkaz na komentáre

pondelok, 27 máj 2024 17:20

Napísal(a) bokep indonesia

pondelok, 27 máj 2024 17:20

Napísal(a) bokep indonesia

This paragraph offers clear idea in support of the new viewers of blogging,

that in fact how to do blogging. -

Odkaz na komentáre

pondelok, 27 máj 2024 17:17

Napísal(a) https://numeracy.wiki/index.php/User:KrisKotter

pondelok, 27 máj 2024 17:17

Napísal(a) https://numeracy.wiki/index.php/User:KrisKotter

Useful info. Lucky me I discovered your website accidentally, and I am shocked

why this accident didn't took place earlier! I bookmarked it. https://numeracy.wiki/index.php/User:KrisKotter -

Odkaz na komentáre

pondelok, 27 máj 2024 17:11

Napísal(a) get started

pondelok, 27 máj 2024 17:11

Napísal(a) get started

In the realm of forex trading, staying abreast of fundamental

factors is paramount, because they shape market sentiment, influence currency valuations, and drive price movements.

From economic indicators to geopolitical events, many factors donate to

the dynamic landscape of forex markets. This article delves to the significance of fundamental analysis

in forex trading, concentrating on the analysis of economic data and

news events to produce informed trading decisions.

Understanding Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of currencies by assessing economic, political, and

social factors that impact supply and demand dynamics. Unlike technical analysis,

which relies on historical price data, fundamental analysis

centers around the underlying forces driving market movements.

Traders analyze various economic indicators, central bank policies, geopolitical

developments, and news events to gauge the fitness of economies and anticipate currency fluctuations.

Analyzing Economic Data

1. GDP (Gross Domestic Product):

GDP measures the full total value of goods and services produced within a

country's borders and serves as a key indicator of economic health.

Traders monitor GDP reports to assess the strength of an economy and anticipate currency movements accordingly.

A strong GDP growth often contributes to currency appreciation, while a

contraction may trigger depreciation.

2. Interest Rates:

Central banks use interest rates as a monetary policy tool to

manage inflation and stimulate economic growth.

Changes in interest rates influence borrowing costs,

investment decisions, and currency valuations. Traders closely monitor central bank announcements and

interest rate decisions, as shifts in monetary policy can significantly impact currency markets.

3. Inflation (Consumer Price Index):

Inflation measures the rate of which prices of goods and services rise

over time. Central banks aim to keep stable inflation rates conducive to

economic stability and growth. Traders scrutinize inflation data,

including the Consumer Price Index (CPI), to assess purchasing power and anticipate central

bank actions regarding monetary policy adjustments.

Reacting to News Events

1. Central Bank Announcements:

Central banks play a pivotal role in shaping currency valuations through monetary policy decisions, such as for instance interest rate changes, quantitative easing, and forward guidance.

Traders closely monitor central bank meetings and announcements, analyzing

policymakers' statements for insights into future policy directions.

2. Geopolitical Events:

Geopolitical developments, including elections, trade negotiations, geopolitical

tensions, and geopolitical crises, may have profound effects on currency markets.

Traders assess geopolitical risks and their potential

impact on investor sentiment, capital flows, and currency valuations, adjusting their trading strategies

accordingly.

3. Economic Releases:

Key economic indicators, such as employment reports, retail sales, manufacturing data, and trade balances,

provide valuable insights into the fitness of economies

and their respective currencies. Traders answer economic releases by

assessing whether data deviates from market expectations and adjusting their positions based on the

perceived implications for currency movements.

Incorporating Fundamental Analysis into Trading Strategies

Successful forex trading entails integrating fundamental analysis

into a comprehensive trading strategy that combines both fundamental and technical

insights. Traders leverage economic calendars, news feeds,

and analysis tools to monitor fundamental factors, assess

market sentiment, and make informed trading decisions.

By understanding the interplay between economic data,

news events, and currency movements, traders gain a competitive edge in navigating the

dynamic landscape of forex markets confidently and precision. -

Odkaz na komentáre

pondelok, 27 máj 2024 17:11

Napísal(a) Zacharyhodah

pondelok, 27 máj 2024 17:11

Napísal(a) Zacharyhodah

Opened up an enthralling read – I'd like to share it with you http://anatoliyrud.ekafe.ru/viewforum.php?f=29

-

Odkaz na komentáre

pondelok, 27 máj 2024 17:10

Napísal(a) Rara Travel Tour

pondelok, 27 máj 2024 17:10

Napísal(a) Rara Travel Tour

I am sure this paragraph has touched all the internet people, its really

really pleasant piece of writing on building up new webpage. -

Odkaz na komentáre

pondelok, 27 máj 2024 17:10

Napísal(a) discover more

pondelok, 27 máj 2024 17:10

Napísal(a) discover more

In the realm of forex trading, staying abreast of fundamental factors is paramount,

while they shape market sentiment, influence currency

valuations, and drive price movements. From economic indicators to

geopolitical events, a myriad of factors subscribe to the dynamic landscape of forex markets.

This informative article delves to the significance of fundamental analysis

in forex trading, focusing on the analysis of economic data and news events to create informed trading decisions.

Understanding Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic

value of currencies by assessing economic,

political, and social factors that impact supply and demand dynamics.

Unlike technical analysis, which depends on historical price data, fundamental analysis

centers on the underlying forces driving market movements.

Traders analyze various economic indicators, central bank policies, geopolitical developments, and news events to

gauge the fitness of economies and anticipate currency fluctuations.

Analyzing Economic Data

1. GDP (Gross Domestic Product):

GDP measures the sum total value of goods and services produced inside

a country's borders and serves as an integral indicator of economic health.

Traders monitor GDP reports to assess the effectiveness of an economy and anticipate currency movements accordingly.

A robust GDP growth often contributes to currency appreciation,

while a contraction may trigger depreciation.

2. Interest Rates:

Central banks use interest rates as a monetary policy tool to regulate inflation and stimulate economic growth.

Changes in interest rates influence borrowing costs, investment decisions,

and currency valuations. Traders closely monitor central bank announcements and interest rate decisions, as shifts in monetary policy can significantly

impact currency markets.

3. Inflation (Consumer Price Index):

Inflation measures the rate at which prices of goods and services rise over time.

Central banks aim to maintain stable inflation rates conducive to economic stability

and growth. Traders scrutinize inflation data, including the Consumer Price Index (CPI), to

assess purchasing power and anticipate central

bank actions regarding monetary policy adjustments.

Reacting to News Events

1. Central Bank Announcements:

Central banks play a pivotal role in shaping currency valuations through monetary policy

decisions, such as interest rate changes, quantitative easing, and forward guidance.

Traders closely monitor central bank meetings and announcements,

analyzing policymakers' statements for insights into future policy directions.

2. Geopolitical Events:

Geopolitical developments, including elections, trade negotiations,

geopolitical tensions, and geopolitical crises, can have profound effects on currency markets.

Traders assess geopolitical risks and their potential affect investor sentiment, capital

flows, and currency valuations, adjusting their trading strategies accordingly.

3. Economic Releases:

Key economic indicators, such as for instance

employment reports, retail sales, manufacturing data, and

trade balances, provide valuable insights into the fitness of economies and their respective currencies.

Traders react to economic releases by assessing whether data

deviates from market expectations and adjusting their positions based on the

perceived implications for currency movements.

Incorporating Fundamental Analysis into Trading Strategies

Successful forex trading entails integrating fundamental analysis into an extensive

trading strategy that combines both fundamental

and technical insights. Traders leverage economic calendars, news

feeds, and analysis tools to monitor fundamental factors, assess market

sentiment, and make informed trading decisions. By understanding

the interplay between economic data, news events, and currency movements,

traders gain a competitive edge in navigating

the dynamic landscape of forex markets with full confidence and precision. -

Odkaz na komentáre

pondelok, 27 máj 2024 17:09

Napísal(a) повышение рейтинга домена

pondelok, 27 máj 2024 17:09

Napísal(a) повышение рейтинга домена

Страсть к веб-сайту -- очень индивидуально дружелюбно

и много, чтобы увидеть! Посетите также мою страничку повышение рейтинга домена -

Odkaz na komentáre

pondelok, 27 máj 2024 17:09

Napísal(a) holiday88.sbs

pondelok, 27 máj 2024 17:09

Napísal(a) holiday88.sbs

Simply want to say your article is as astonishing. The clearness

in your submit is just nice and i could assume you are an expert in this subject.

Fine with your permission let me to seize your feed to

keep updated with impending post. Thank you a million and please keep up the rewarding work. -

Odkaz na komentáre

pondelok, 27 máj 2024 17:09

Napísal(a) Site Link Sales

pondelok, 27 máj 2024 17:09

Napísal(a) Site Link Sales

Hello! I realize this is sort of off-topic however I needed to

ask. Does building a well-established website like yours take

a massive amount work? I am brand new to blogging however I do write in my journal on a daily

basis. I'd like to start a blog so I can easily share my own experience

and views online. Please let me know if you have any kind of

recommendations or tips for new aspiring blog owners. Appreciate it!

Napíšte komentár

Vyplňte všetky povinné polia označené (*). HTML kód nie je povolený.

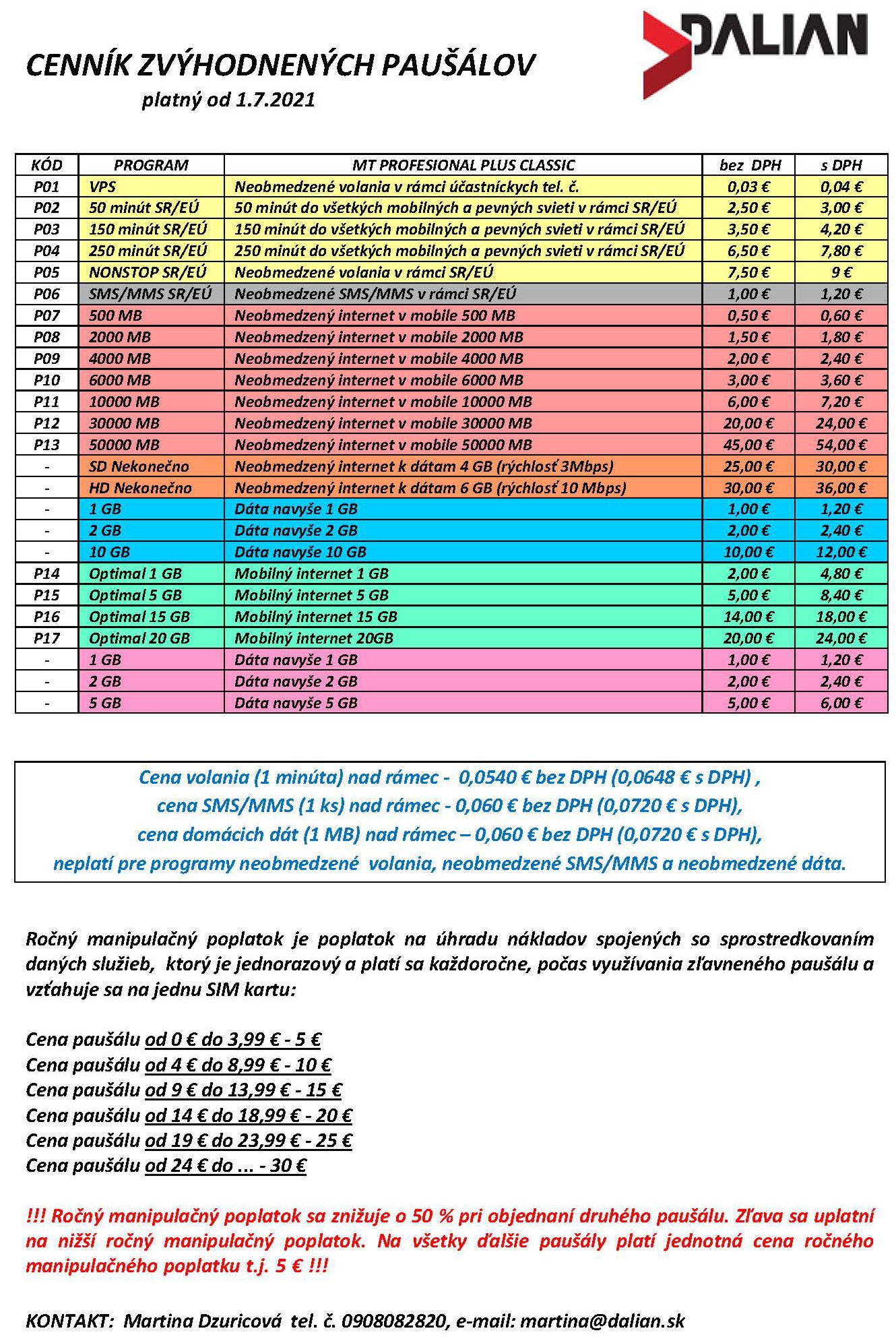

Pripravili sme viacero výhod pre členov OZH a ich rodiny.

V prípade akýchkoľvek otázok ako môžete tieto výhody využiť

kontaktujte Dalian s.r.o.:

+421 908 622 860

Bibiana Mathiová

hasici@dalian.sk

Spolu dokážeme viac

Odborový zväz hasičov

Drieňová 22

Bratislava

826 86

tel.: +421(0)692044461

IČO: 30811261

č.ú.: 4007856539/7500 - ČSOB

IBAN : SK26 7500 0000 0040 0785 6539